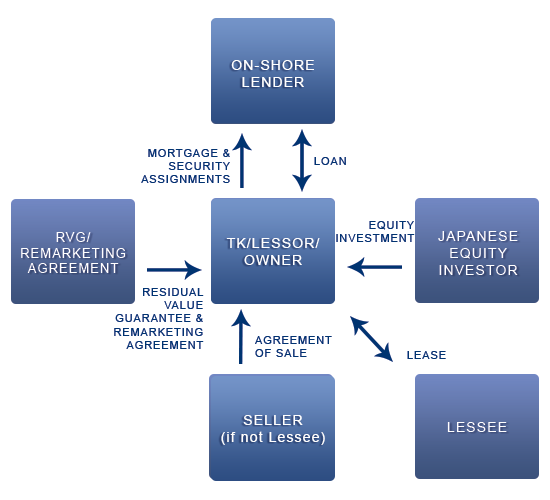

How a Japanese Operating Lease works

The flow of funds and the related loan and lease agreements among the participants in a JOL are shown below. In a JOL, the aircraft purchased by the Japanese equity investor is often a used aircraft. The Japanese equity investor funds approximately 20-30% of the acquisition cost of the aircraft and becomes the owner of the aircraft via a Special Purpose Entity called a TK. An international bank with on-shore lending capabilities provides the balance of the aircraft purchase price (approximately 70-80%) via a senior secured mortgage loan. The senior loan is structured such that the loan will amortize to a balloon payment due at maturity. The Lessee pays rent to the SPC which is sufficient to pay the monthly loan payment including a minimal dividend return to the Japanese equity. To insure the residual value of the aircraft at the lease maturity, the owner of the aircraft often enters into an agreement with a Remarketing Agent during the lease negotiations to insure the sale or release of the aircraft and may also obtain a Residual Value Guaranty.

Need to know more? I usually answer questions the same day.

* Please note that your email address will never be sold or used for unsolicited communication.